BUSINESS NEWS - South Africa’s economic performance over the last few years has been, at best, underwhelming. Earlier this month, Statistics South Africa confirmed that the economy grew just 0.8% in 2018, after 1.4% growth in 2017.

Even in isolation, these are not appetising numbers, but economist Dave Mohr, chief investment strategist at Old Mutual Multi-Managers, believes it’s important to put them in context.

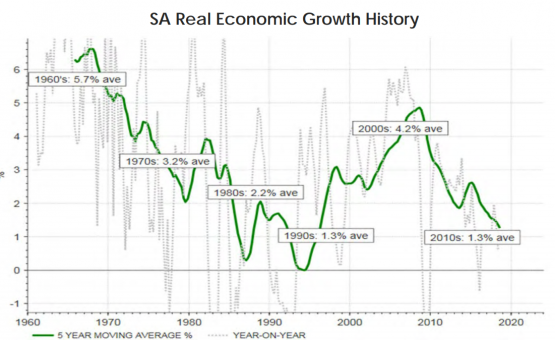

The last time South Africa enjoyed a sustained period of GDP growth above 5% was in the 1960s. More recently, the country saw higher growth in the 2000s, of above 4%.

“Both of these periods had strong links to commodity prices,” Mohr points out. “In the 1960s, it was as the Free State gold fields came on line. In the 2000s we had an enormous commodity boom, when everyone started fearing that China was going to use up all the commodities on our planet.”

Source: Thomson Reuters Datastream/Old Mutual Multi-Managers

The current low-growth environment is, unfortunately, not exceptional.

“We’ve been here in the past, if you look at the turbulent period at the end of the 1980s and the beginning of the 1990s,” Mohr points out. “We had a three- to four-year economic recession, and growth averaged around 1.3% in the 1990s.”

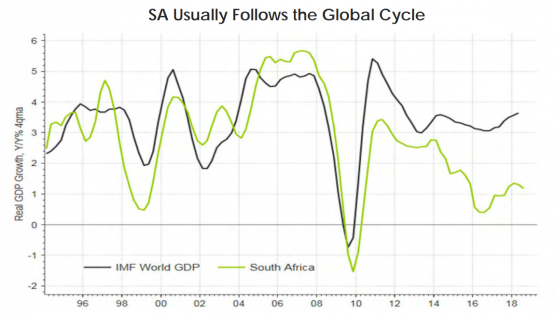

What is perhaps of greater concern is that South Africa’s trajectory has decoupled somewhat from what is happening globally.

Source: Thomson Reuters Datastream/Old Mutual Multi-Managers

“Over the last 20 years there has always been a good correlation between global growth and South African growth,” Mohr points out. “But unfortunately, over the last three quarters of a decade, we have been underperforming.”

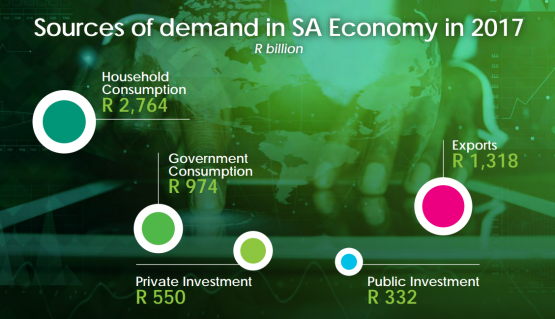

Broadly speaking, the main reason for this is South Africa’s declining competitiveness. At a high level, this is illustrated by the graphic below, which shows demand-side spending in the local economy.

Source: Old Mutual Multi-Managers

The most concerning thing about this picture is export performance.

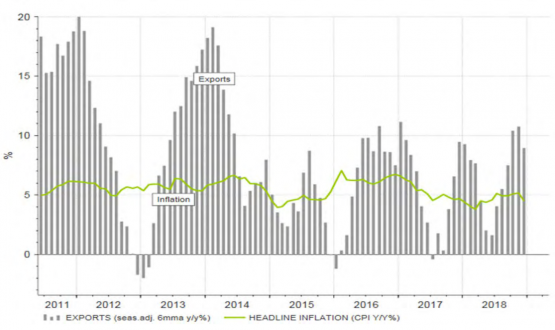

“You want export revenues to grow faster than domestic inflation so that the real incomes of our exporters are growing,” says Mohr. “Since 2014 there have been periods when exports have grown faster, but on balance not much faster than inflation. That shows you that, in terms of competitiveness, we are not improving.”

This is despite what has happened to the rand.

“A weaker currency should boost rand incomes of our exporters, but it’s failed to do that even though it has gone from R10 to the dollar to R14 to the dollar,” says Mohr.

Source: Thomson Reuters Datastream/Old Mutual Multi-Managers

The same conclusion can be drawn from looking at what percentage of total demand in the local economy is produced locally. This too has been in decline.

‘If you are failing to meet the demand in your own economy, it means you are not competitive in the global world,’ says Mohr. ‘That is one of the fundamental problems of our economy.’

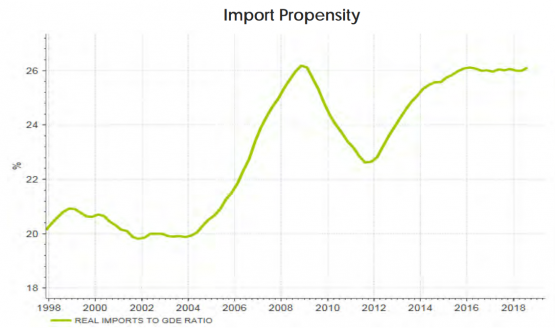

As the chart below shows, more than a quarter of local consumption is now sourced from outside the country.

Source: Thomson Reuters Datastream/Old Mutual Multi-Managers

“At the beginning of the previous decade about 20% of our demand was satisfied from offshore,” Mohr points out. “It is now 26%. That is 6% of the total economy we have lost. This is damning evidence that SA is not competitive.”

This is the key factor that needs to be addressed for South Africa to prosper going forward. For the economy to grow at sustainably high rates, domestic consumption will never be enough on its own. After all, South Africa makes up less than 0.5% of the global economy.

It’s worth noting that the high growth rates the country experienced in the 1960s and the 2000s were due to exports, even though these were commodities. That shows that export performance is the predominant driver of economic growth.

This will always be the case simply because there is a far, far bigger market outside of the country’s borders than inside them. To change this country’s growth trajectory, steps therefore have to be taken to create an environment in which local businesses can compete in the global marketplace.

‘Exports, for any economy, are by far the biggest potential source of demand,’ says Mohr. ‘If you look at countries that have been successful in substantially lifting economic growth over time, they all have one common factor: they have tapped into global demand.’